Underwriting

Mortgage Underwriting

Story

Mortgage underwriting is a complex solution to a complex problem in a complex industry. In order to qualify for a mortgage, a borrower has to provide a detailed description of their income, assets, and financial obligations. This mountain of paperwork (yes, even today it’s often paper) has to be thoroughly analyzed by an often overworked underwriter. With a team including myself, both an internal and external designer, project manager and 12 developers we set out.

Problem

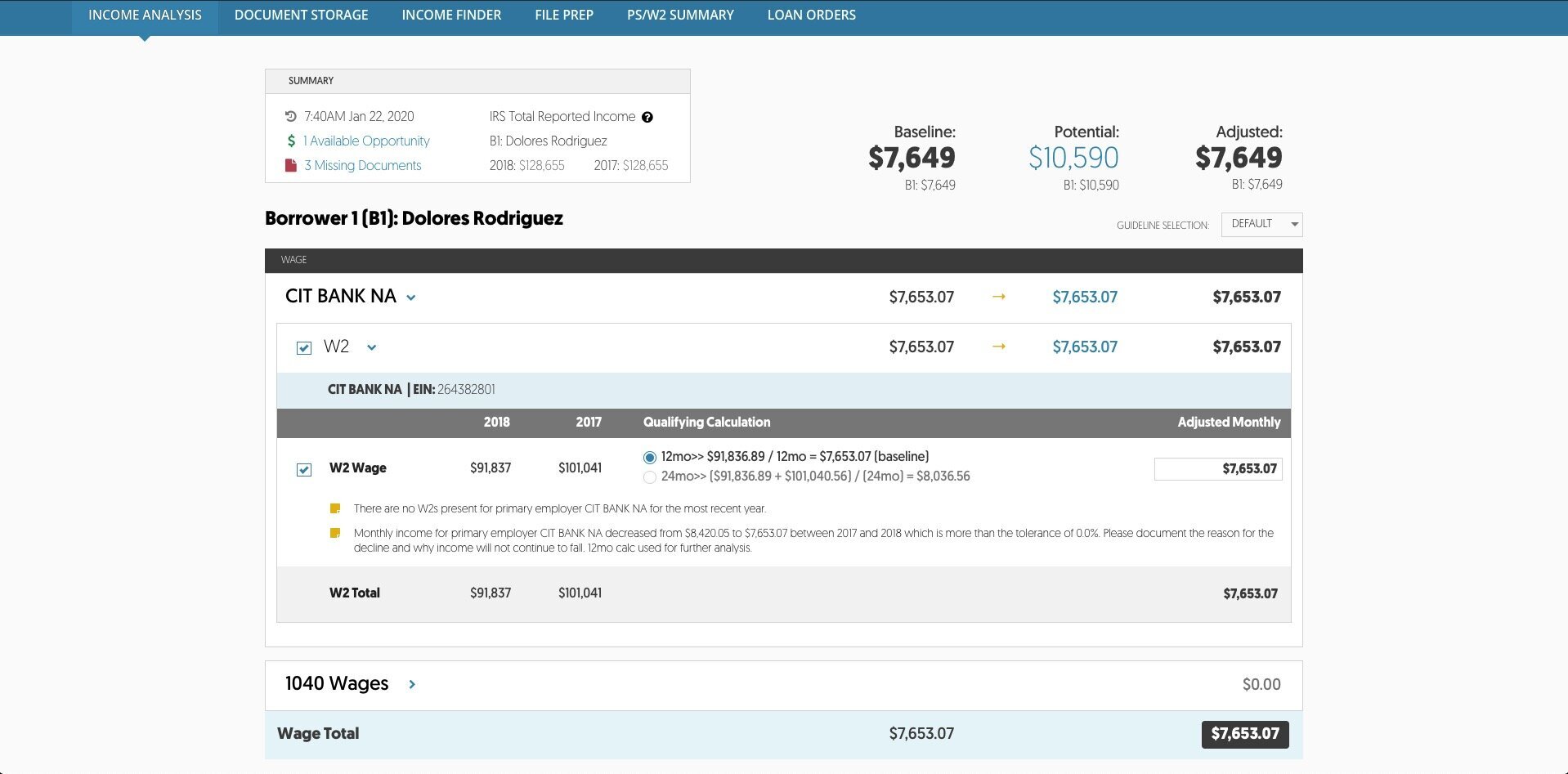

Underwriters today use a myriad of tools - often home-grown Excel workbooks and a calculator - to determine a borrower’s “real” monthly income. A complex combination of post-Recession lending regulations makes this a tall order for high-dollar mortgages being paid by a borrower’s self-employment income, complex commissions, or rental properties.

Enter FactCheck - a powerful tool for capturing and summarizing data from financial documents into one Excel file, already in production on our servers. So what’s the problem? Enter the “Workbook” - the spreadsheet to end all spreadsheets, encompassing the many (many) nuances and edge cases of income calculation across dozens of tabs, hundreds of cells, and thousands of unique rules.

My goal was to adapt the FactCheck workbook from a complicated, offline Excel workbook into a flexible, user-friendly web application .

Approach

Build deep domain knowledge of problem: Underwriting is not something to take lightly, as their decisions whether or not to lend can deeply impact a lender’s profitability and book of business. I conducted interviews and shadowed underwriters on the job, performed competitive analysis of their tools, and constructed personas based on their specialties. I also engaged in regular learning sessions with industry professionals to understand the entire process they must follow.

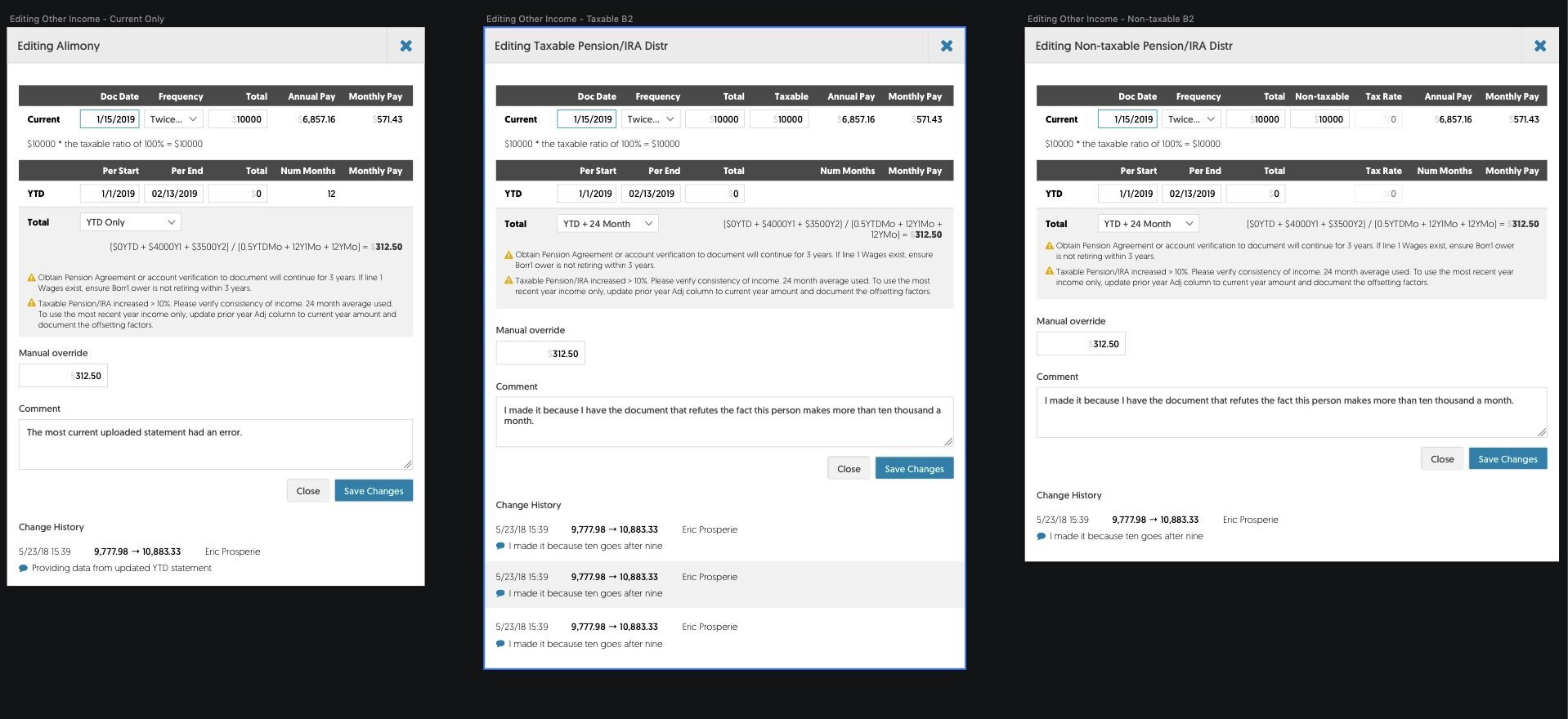

Minimum Viable vs. Minimum Marketable vs. Minimum Delightful: You can’t underwrite a loan halfway. Based on user and client feedback I helped define an MVP product that balanced simplifying a deeply complex current state, solving enough problems that an underwriter could actually do their job with an MVP, but still feel that their process and experience had improved.

Build for the future: Underwriting is all edge cases - happy paths are a joke. The experience that my MVP created had to be adaptable and ready to grow at a moments notice - flows and processes that worked for analyzing paystubs would need to work for W2’s, the UI that described an 1120s needed to work for a 1065, your first rental property needed to be as easy to evaluate as your fiftieth. I also need to build processes that could be a platform for future machine learning, to serve as an input for future AI.

Results

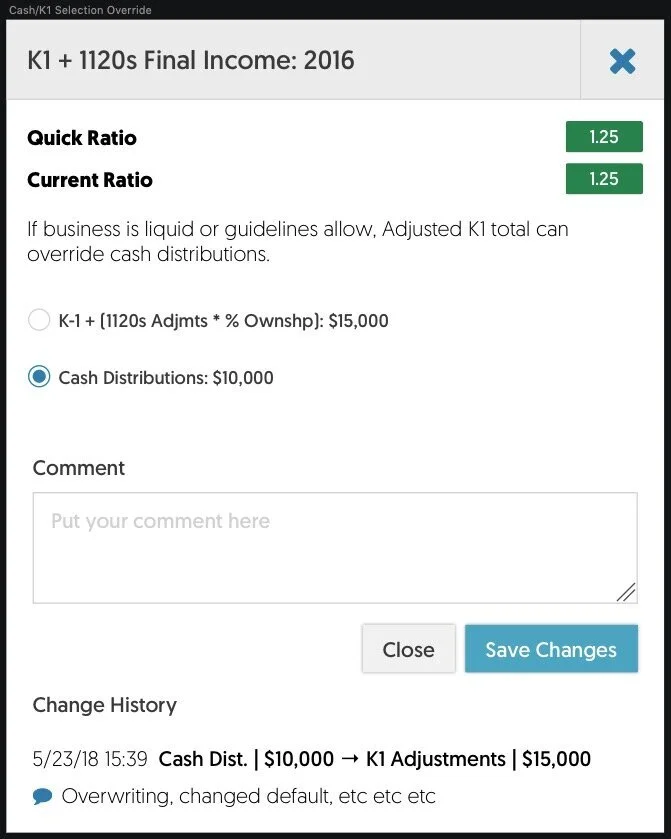

My first user to gasp: Calculating the liquidity of a business is often a mortgage underwriter’s least favorite job. In a usability test for streamlined process based on the knowledge and feedback of her peers, an underwriter gasped seeing she’d be able to do the process in one click. I was able to design this experience by understanding the data sources necessary, working with development to devise a method to store and share, and a limited UI that maintained only essential functions.

Surviving the summer: Mortgage season peaks in summer, and is a challenge for everyone in the origination process. Through my feedback sessions I was told by a chief underwriter that this new UI would enable them to survive the summer. By reducing complex processes to small tasks and displaying disparate data in a single, legible interface they would spend less time on grunt work and have more flexibility to solve real problems.